All Categories

Featured

Table of Contents

The major distinctions between a term life insurance coverage policy and an irreversible insurance coverage (such as entire life or universal life insurance policy) are the duration of the policy, the buildup of a cash value, and the cost. The best choice for you will rely on your needs. Right here are some points to think about.

People who possess whole life insurance policy pay much more in premiums for less insurance coverage however have the security of understanding they are secured for life. 30-year level term life insurance. Individuals who get term life pay premiums for an extended duration, however they get absolutely nothing in return unless they have the misery to die prior to the term runs out

Significant management charges frequently cut right into the rate of return. This is the source of the expression, "acquire term and spend the difference." The performance of long-term insurance policy can be consistent and it is tax-advantaged, providing extra advantages when the stock market is unstable. There is no one-size-fits-all response to the term versus irreversible insurance coverage dispute.

The motorcyclist assures the right to convert an in-force term policyor one ready to expireto a long-term plan without experiencing underwriting or showing insurability. The conversion motorcyclist ought to enable you to convert to any kind of irreversible plan the insurance provider supplies without any limitations. The key attributes of the cyclist are maintaining the original health and wellness rating of the term plan upon conversion (even if you later on have wellness issues or end up being uninsurable) and deciding when and how much of the coverage to transform.

Best Level Term Life Insurance

Of program, overall costs will certainly enhance dramatically because entire life insurance is much more costly than term life insurance policy - Level term life insurance policy options. Clinical conditions that establish throughout the term life period can not create costs to be boosted.

Term life insurance policy is a reasonably inexpensive method to supply a round figure to your dependents if something happens to you. If you are young and healthy, and you support a family members, it can be a good choice. Whole life insurance policy comes with significantly greater month-to-month costs. It is meant to provide protection for as lengthy as you live.

It depends upon their age. Insurance provider established a maximum age limit for term life insurance policy policies. This is normally 80 to 90 years of ages, but might be greater or lower depending on the business. The premium likewise rises with age, so a person aged 60 or 70 will certainly pay substantially greater than somebody years younger.

Term life is rather similar to car insurance policy. It's statistically unlikely that you'll need it, and the premiums are money down the tubes if you do not. If the worst happens, your family members will get the advantages.

What is the difference between Level Term Life Insurance and other options?

___ Aon Insurance Policy Providers is the brand name for the brokerage firm and program administration operations of Affinity Insurance coverage Services, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Company, Inc. (CA 0795465); in OK, AIS Affinity Insurance Solutions Inc.; in CA, Aon Affinity Insurance Coverage Providers, Inc.

The Plan Representative of the AICPA Insurance Policy Depend On, Aon Insurance Policy Services, is not associated with Prudential. Team Insurance protection is issued by The Prudential Insurance Policy Firm of America, a Prudential Financial business, Newark, NJ.

Essentially, there are 2 sorts of life insurance policy prepares - either term or irreversible plans or some mix of the two. Life insurance firms use different kinds of term strategies and conventional life plans in addition to "passion delicate" items which have ended up being a lot more prevalent because the 1980's.

Term insurance supplies protection for a given period of time - Level term life insurance for seniors. This period can be as brief as one year or provide coverage for a specific variety of years such as 5, 10, two decades or to a specified age such as 80 or in some situations as much as the oldest age in the life insurance policy mortality tables

How long does Fixed Rate Term Life Insurance coverage last?

Presently term insurance coverage rates are very competitive and among the most affordable traditionally seasoned. It needs to be noted that it is a commonly held belief that term insurance is the least pricey pure life insurance policy coverage available. One needs to assess the policy terms carefully to choose which term life options are appropriate to satisfy your specific scenarios.

With each new term the premium is enhanced. The right to restore the plan without evidence of insurability is a crucial benefit to you. Otherwise, the risk you take is that your wellness may deteriorate and you may be not able to get a plan at the very same rates or also in any way, leaving you and your recipients without coverage.

You have to exercise this alternative during the conversion period. The length of the conversion period will certainly vary relying on the type of term plan purchased. If you transform within the recommended duration, you are not needed to provide any kind of info regarding your wellness. The costs rate you pay on conversion is generally based upon your "current attained age", which is your age on the conversion day.

Who has the best customer service for Guaranteed Level Term Life Insurance?

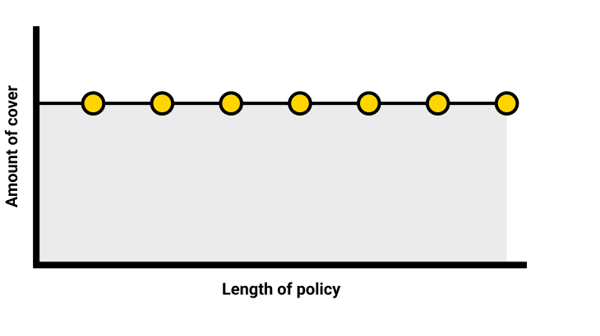

Under a level term policy the face amount of the plan continues to be the same for the whole period. Usually such policies are sold as home mortgage protection with the amount of insurance decreasing as the equilibrium of the home loan lowers.

Typically, insurance firms have actually not can transform premiums after the plan is marketed. Considering that such plans may continue for years, insurance firms need to utilize conservative mortality, rate of interest and expenditure rate estimates in the premium estimation. Flexible premium insurance, nevertheless, allows insurance firms to supply insurance at reduced "current" premiums based upon less conventional presumptions with the right to change these premiums in the future.

While term insurance policy is made to offer protection for a defined time period, irreversible insurance policy is created to provide insurance coverage for your whole lifetime. To maintain the costs rate degree, the premium at the more youthful ages surpasses the actual price of defense. This additional costs develops a book (money worth) which helps pay for the plan in later years as the price of protection increases over the premium.

20-year Level Term Life Insurance

With level term insurance, the price of the insurance will certainly stay the same (or potentially decrease if rewards are paid) over the term of your plan, normally 10 or twenty years. Unlike long-term life insurance coverage, which never ever expires as long as you pay costs, a level term life insurance policy policy will finish at some time in the future, commonly at the end of the duration of your degree term.

Because of this, many individuals make use of irreversible insurance coverage as a stable monetary planning device that can serve many requirements. You may have the ability to transform some, or all, of your term insurance throughout a set duration, generally the very first 10 years of your policy, without needing to re-qualify for insurance coverage even if your health has altered.

How can I secure Level Term Life Insurance Policy Options quickly?

As it does, you may want to add to your insurance coverage in the future. As this takes place, you may desire to ultimately lower your fatality advantage or consider converting your term insurance coverage to an irreversible policy.

So long as you pay your premiums, you can relax easy knowing that your liked ones will certainly obtain a survivor benefit if you pass away throughout the term. Many term plans permit you the capacity to transform to irreversible insurance without having to take one more wellness exam. This can enable you to capitalize on the fringe benefits of a long-term plan.

Latest Posts

Funeral Policy Companies

Final Expenses Insurance For Seniors

Senior Final Expense Benefits