All Categories

Featured

Table of Contents

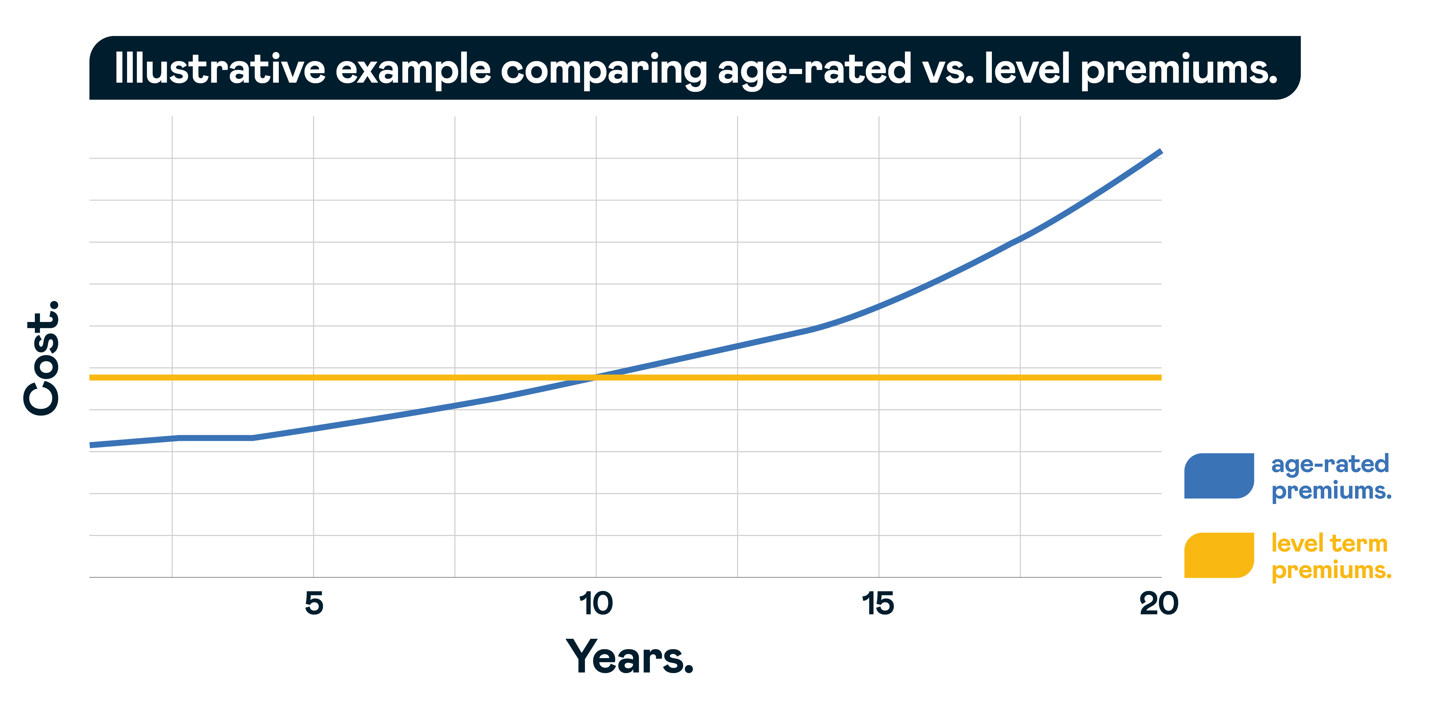

That normally makes them a much more affordable choice forever insurance protection. Some term policies might not keep the premium and survivor benefit the exact same in time. Term Life Insurance. You do not want to mistakenly assume you're getting level term coverage and afterwards have your survivor benefit modification later on. Many individuals get life insurance policy coverage to help economically shield their enjoyed ones in situation of their unforeseen death.

Or you may have the alternative to convert your existing term protection right into a long-term plan that lasts the remainder of your life. Various life insurance coverage policies have possible advantages and drawbacks, so it is very important to comprehend each prior to you choose to buy a plan. There are numerous benefits of term life insurance policy, making it a prominent choice for insurance coverage.

As long as you pay the premium, your recipients will get the survivor benefit if you die while covered. That stated, it is necessary to note that many policies are contestable for 2 years which means insurance coverage might be retracted on fatality, must a misrepresentation be discovered in the app. Policies that are not contestable typically have a graded death advantage.

Why You Should Consider Level Term Life Insurance Meaning

Costs are usually lower than entire life policies. You're not locked into a contract for the remainder of your life.

And you can not pay out your policy during its term, so you won't get any financial gain from your past protection. As with various other kinds of life insurance policy, the cost of a degree term policy relies on your age, insurance coverage requirements, work, way of living and health and wellness. Typically, you'll find a lot more budget friendly protection if you're younger, healthier and less high-risk to insure.

Since degree term premiums remain the exact same throughout of protection, you'll recognize precisely just how much you'll pay each time. That can be a big assistance when budgeting your expenditures. Degree term protection likewise has some versatility, allowing you to tailor your plan with added features. These usually been available in the kind of bikers.

Everything You Need to Know About What Is Level Term Life Insurance

You may have to meet details problems and qualifications for your insurance provider to pass this rider. There likewise can be an age or time limitation on the protection.

The death advantage is generally smaller, and coverage usually lasts until your youngster turns 18 or 25. This cyclist might be a much more cost-effective means to assist ensure your kids are covered as cyclists can typically cover several dependents at the same time. When your child ages out of this protection, it might be feasible to transform the biker right into a brand-new policy.

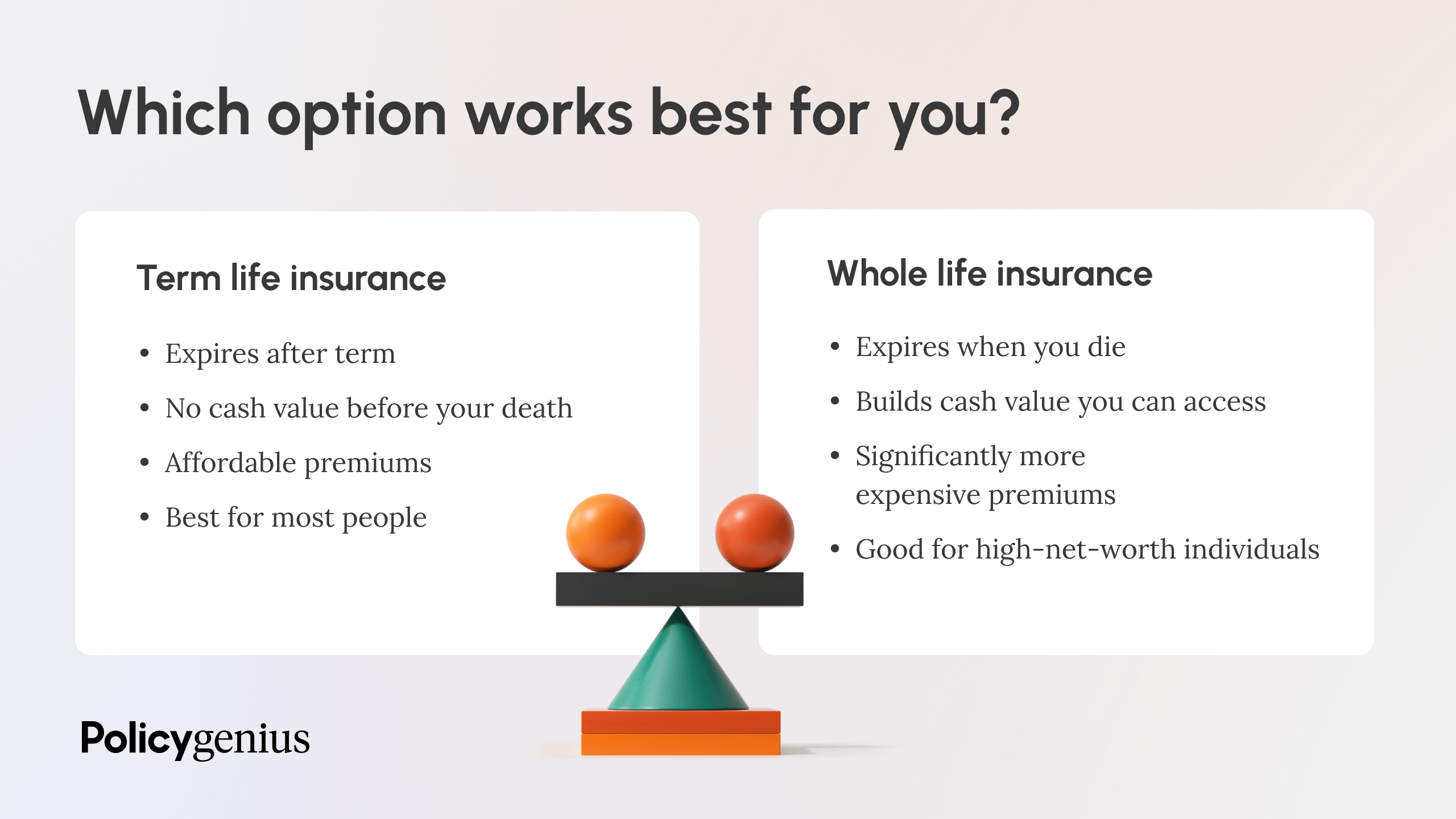

When contrasting term versus permanent life insurance, it's vital to keep in mind there are a couple of various kinds. The most common sort of permanent life insurance policy is whole life insurance coverage, but it has some crucial differences compared to level term protection. Guaranteed level term life insurance. Right here's a basic overview of what to think about when comparing term vs.

Whole life insurance policy lasts permanently, while term protection lasts for a details period. The premiums for term life insurance policy are typically reduced than whole life insurance coverage. Nonetheless, with both, the premiums continue to be the very same for the duration of the policy. Entire life insurance coverage has a cash value component, where a part of the premium may expand tax-deferred for future demands.

One of the primary attributes of degree term insurance coverage is that your costs and your death benefit do not transform. You might have protection that starts with a fatality benefit of $10,000, which can cover a home mortgage, and then each year, the death benefit will decrease by a set amount or percent.

Due to this, it's commonly a much more budget-friendly kind of degree term insurance coverage. You may have life insurance policy via your company, but it may not suffice life insurance policy for your needs. The initial step when buying a policy is figuring out just how much life insurance policy you require. Take into consideration variables such as: Age Family members size and ages Employment status Revenue Financial debt Lifestyle Expected last expenses A life insurance calculator can assist figure out just how much you require to begin.

What is Term Life Insurance For Couples? Quick Overview

After deciding on a policy, finish the application. If you're accepted, authorize the documentation and pay your initial costs.

Consider scheduling time each year to evaluate your plan. You may intend to upgrade your beneficiary info if you've had any type of significant life adjustments, such as a marriage, birth or divorce. Life insurance policy can occasionally really feel complex. However you do not have to go it alone. As you discover your options, think about discussing your demands, wants and interests in a monetary specialist.

No, degree term life insurance doesn't have money value. Some life insurance policy plans have an investment attribute that enables you to build money worth with time. A part of your premium payments is set apart and can gain rate of interest over time, which expands tax-deferred throughout the life of your protection.

These plans are often significantly much more pricey than term protection. If you get to the end of your policy and are still to life, the insurance coverage ends. Nonetheless, you have some options if you still want some life insurance protection. You can: If you're 65 and your coverage has run out, for instance, you may want to purchase a new 10-year level term life insurance policy.

What is 20-year Level Term Life Insurance? Find Out Here

You may be able to transform your term protection right into an entire life plan that will last for the rest of your life. Numerous kinds of degree term policies are convertible. That suggests, at the end of your protection, you can convert some or every one of your policy to entire life coverage.

A degree costs term life insurance strategy lets you stick to your budget plan while you help protect your family members. ___ Aon Insurance Coverage Services is the brand name for the broker agent and program management operations of Fondness Insurance coverage Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Policy Company, Inc. (CA 0795465); in OK, AIS Fondness Insurance Policy Providers Inc.; in CA, Aon Affinity Insurance Coverage Services, Inc .

Latest Posts

What is Direct Term Life Insurance Meaning Coverage Like?

All About Decreasing Term Life Insurance Coverage

How Does Simplified Term Life Insurance Keep You Protected?